Get Your Settlement Expedited. Call 800-572-7914

Commercial Claim Help DRC

Commercial Claim Help from Experienced Public Adjusters

A commercial claim or business insurance claim can be highly complex and the slightest oversight could translate into substantial unclaimed losses and precious time.

There are many areas of coverage under most standard business insurance policies. Our experienced public adjusters and commercial claim consultants work tirelessly to ensure that every aspect of your business insurance policy claim is given consideration, including, but not limited to:

Loss of Use / Loss of Rents

Business interruption

Extended coverage

Continuing expenses

Extra Expenses

Where to Start

Commercial claims are time-consuming and complicated – and you have a business to run. We highly recommend starting with a free, no obligation consultation with a public insurance adjuster as experienced public adjusters can ease your burden by allowing you to focus on rebuilding or restarting your business. Most importantly, an experienced public adjuster has the resources and expertise needed to maximize your claim settlement in the quickest way possible.

Not quite ready to take that step or determined to do it on your own? Use the tips below to get started

with the claims process.

Tips on Handling A Commercial Insurance Claim

- Demand a certified copy of your business insurance policy ASAP. Use online resources such as your state’s Department of Insurance website to find answers to any questions you may have about the policy’s provisions and exclusions.

- Fill out claim forms completely and accurately. Check your policy for definitive deadlines to submit claim forms. You will probably be required to fill out and submit a Proof of Loss. This is a very important document in the claims process. Click here for tips on how to properly submit a Proof of Loss. If something does not apply, write the words “not applicable” or contact us for help.

- Start compiling copies of tax returns, profit and loss statements, lease agreements and inventories. The insurance carrier will request these documents be provided if you have a claim for business income loss.

- Document your losses with digital photos, video and notes. Create a complete inventory with each loss listed and include the item, brand, age, quantity and cost to replace. It’s the policyholder’s responsibility to prove these losses to the insurance company.

- Document all conversations you have with the independent adjuster and take extensive notes.Request that the adjuster put all settlement offers or “promises” in writing.

- Get organized. Buy a portable hanging file box and folders and use it to store your documentation, notes, estimates, insurance correspondence and claims forms. The more organized you are, the better. We recommend using project management software, a task management app, or some other system to keep track of all upcoming tasks.

- Meet with experts. Get independent estimates from local contractors who are qualified to do the repair work.

- Be prepared for disagreements with the in-house adjuster or independent adjuster from your insurance company. Conflicts, oversights, miscalculations, and varying interpretations of policy language are common during the claims process.

What Our Expert Says about Business Insurance Claims :

“Business insurance claims can be highly complex and challenging, even for a seasoned claims professional. Often times the use of outside experts such as forensic CPA’s and cost and valuation engineers are needed to accurately assess and document the full scope of loss or to re-document a claim that has been denied. Failure to get the right experts involved could end up costing you a lot of money.”Visit our FAQ’s to learn more about the claims process.

Choose Insurance Claim Consultants to Handle Your Business Insurance Claim

Avoid costly delays by outsourcing your business insurance claim to Insurance Claim Consultants. We act on your behalf to ensure a fair, fast settlement. With over 50 years of combined experience and unparalleled expertise in business insurance claims, construction, forensics, meteorology, and engineering, we have all of your needs covered. We are adept at interpreting policy language and think beyond the limited scope typical of an insurance company’s investigative approach. And, we have a 100% success rate with getting previously denied claims settled and paid.

We have helped all types of businesses, commercial entities and organizations recover claim settlements. We have handled the following types of commercial claims:

- Church claims

- Hotel and motel claims

- Apartment complex claims

- Hospital claims

- Office park claims

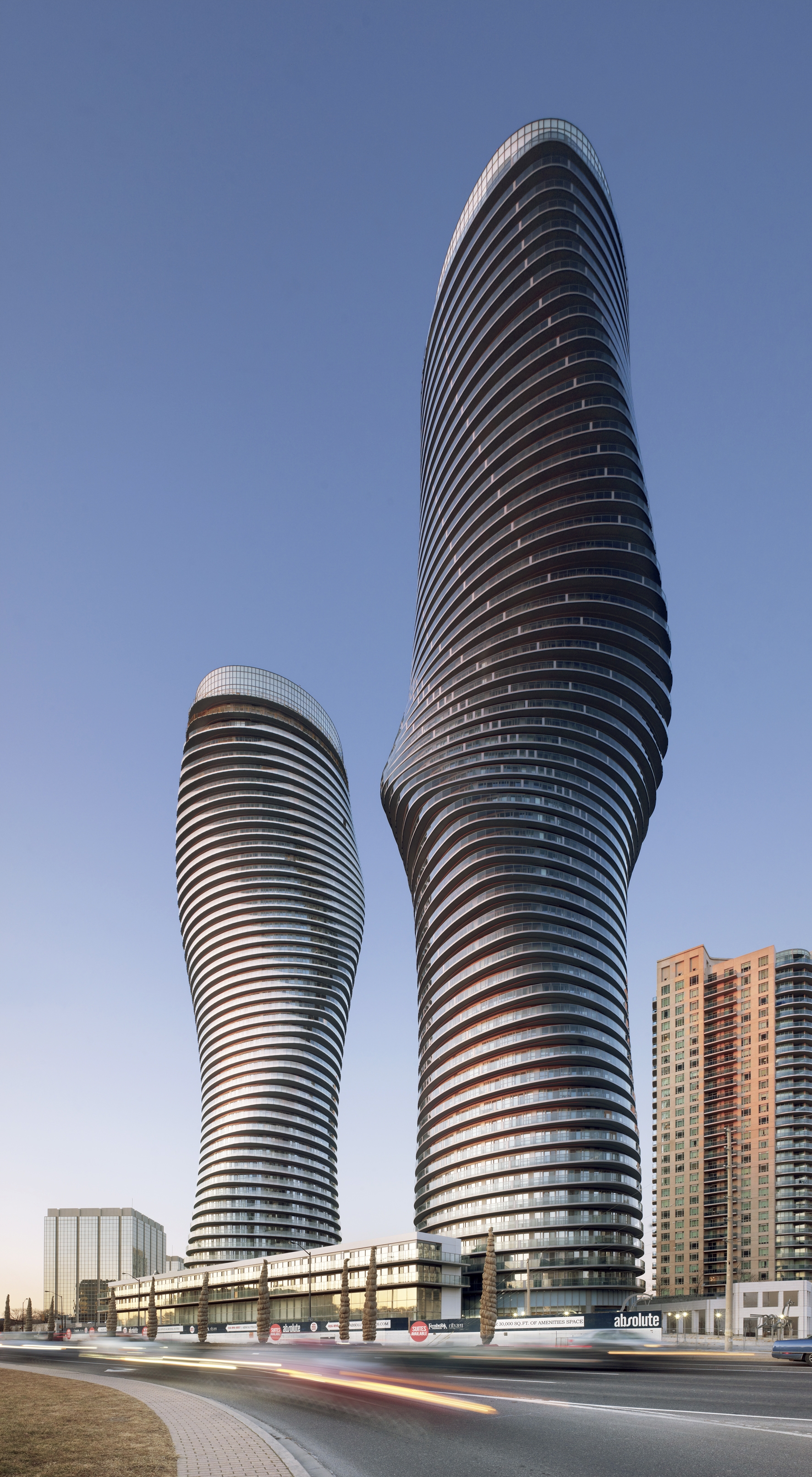

- Condominium association claims

- Restaurant claims

- Colleges and university claims

- Government agency claims

- Shopping center claims

If your claim has been denied, underpaid or is at a standstill, a public adjuster can still help any stage of the claim process.

Insurance company adjusters often deny commercial claims without performing a thorough investigation. It’s your right to have your claim assessed and adjusted in a fair and timely manner. We can help.

Insurance Claim Consultants has successfully won settlements for hundreds of business owners across the U.S. and abroad. We have experienced commercial claim adjusters in St. Louis, Miami, Atlanta, Tampa, Houston and many other cities and states to help you with your business insurance claim.